While looking for a whole lot to your home financing (mortgage), the rate issues. A home loan are an extended-label debt, thus even a tiny difference between focus adds up over time.

Lenders come with different choices featuring. These can provide autonomy or let you pay-off your loan shorter. Some choices may cost you so much more, very make sure that they might be worth it.

Repaired interest rate

A fixed interest remains a similar for a-flat several months (for example, 5 years). The speed up coming visits an adjustable interest rate, you can also discuss several other fixed rate.

- Can make cost management smoother you may already know exactly what your costs might be.

- A lot fewer loan provides could cost you reduced.

- You’ll not have the benefit if the rates of interest drop.

- It could cost more adjust funds later on, if you find yourself charged a rest payment.

Adjustable interest rate

- A great deal more mortgage has may offer your deeper independence.

- It’s usually more straightforward to button financing later, if you discover a much better price.

- Can make budgeting more challenging since your repayments might have to go right up or off.

- So much more mortgage keeps could cost your even more.

Partially-fixed speed

If you’re not sure if a fixed or changeable interest rate suits you, envision a touch of one another. Which have a partially-fixed price (split financing), a portion of your loan has a fixed rates together with rest has an adjustable rate. You could potentially ple, otherwise ).

Financial enjoys become at a price

Lenders with an increase of solutions or has can come on a good higher cost. These could is an offset membership, redraw or credit line place. Some are method of putting additional money into the loan to reduce the quantity of focus you pay.

Weigh up if keeps can be worth it

Such as for instance, assume you are looking at a $five-hundred,one hundred thousand mortgage which have an offset membership. If you’re able to continue $20,100 from coupons about offset, you can easily shell out focus to your $480,one hundred thousand. But if your offset harmony will always be lowest (particularly less than $10,000), it may not getting worthy of spending money on this particular feature.

Avoid using way more getting ‘nice-to-have’ options

When you compare loans, consider your lifetime and just what alternatives you truly need. Exactly what provides is ‘must-haves’? Preciselywhat are ‘nice-to-haves’? Can it be value purchasing extra to possess has actually you’ll never use? You will be better off going for a simple financing with minimal has actually.

Workout what you could afford to acquire

Feel reasonable about what you can afford. Mortgage rates take the rise, therefore allow yourself some respiration space.

Evaluate lenders

With the number you can afford so you can acquire, compare loans away from at the very least a couple of different loan providers. See the financing interest levels, fees and features to discover the best mortgage for your requirements.

Assessment websites can be handy, however they are enterprises and will make money using promoted links. They may maybe not security all your options. See just what to consider while using the investigations other sites.

Using a mortgage broker

With several loan providers to select from, you may also choose to be a mortgage broker to track down financing alternatives for your. Come across having fun with a large financial company to have suggestions for what things to inquire your bank or representative.

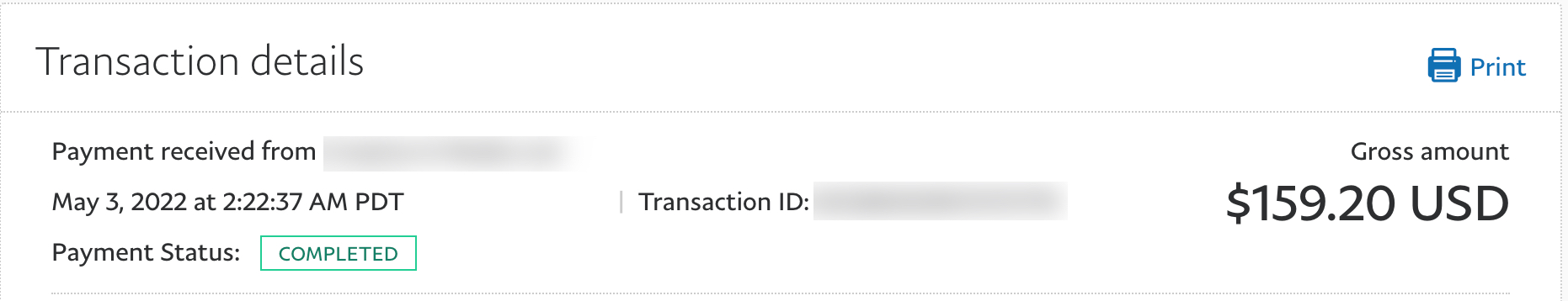

Mai and you may Michael are looking to buy an excellent $600,100 apartment. Obtained stored a beneficial 20% deposit and want to obtain $480,one hundred thousand more than twenty five years.

- rates of interest – varying as opposed to fixed

Ticking various other packets on the website, they look from the financing options to see advice how the purchase price may differ. Considering interest levels is reduced, they intend to squeeze into a variable price. As well as desire to be capable of making additional costs. With your as the strain, they opinion financing choices.

Predicated on the research, they shortlist fund away from one or two loan providers. They approach for every single bank discover an authored offer customised for its state, following choose the best financing.