Having a substantial understanding of the total amount of Va financing closing costs and you may non-mortgage relevant will cost you is an important figure to look at when buying property.

Just as one home mortgage really does, Virtual assistant loans have certain closing costs – charges you are able to owe towards closure big date into the supplier, your own mortgage lender, brand new term providers, or any other events doing work in their deal.

Fortunately, in terms of settlement costs, Virtual assistant loans are far more sensible than other financial solutions – and in many cases, Va people can be inquire owner to pay for a massive show of those.

Exactly what are Virtual assistant Financing Closing costs?

Closing costs are a couple of charges energized in order to a loan borrower. They’re going with the the costs off control, underwriting, and you will giving your own home mortgage, including things like appraising your property, tape their deed into the county, doing a title browse, having a legal professional review one courtroom files, and many more jobs of this their purchase. Local fees also are used in settlement costs.

The borrower’s settlement costs are very different. They will vary widely according to the amount borrowed, where you’re found, and that lender you utilize, and many other activities.

Whatever the closing costs come to, they shall be due towards the closure day – when you sign a final financing paperwork. They are usually repaid playing with good cashier’s have a look at or wire transfer.

Just how much try Va Settlement costs?

Plenty of costs fall under the new closure rates umbrella, and even though each of them vary according to your unique financing scenario, there are some general averages searching so you can in order so you can imagine your.

- Origination charges: Here is the payment (otherwise often a collection of fees) your bank costs so you’re able to originate your loan. Thank goodness, the Va loan origination commission was capped at step 1% of overall amount borrowed, so $dos,one hundred thousand into the good $two hundred,100 financial.

- Appraisal commission: So it discusses your property appraisal, which the Va financial uses to gauge the value of the newest house you will be to shop for otherwise refinancing. So it constantly works between $400 and you can $600.

- Name charges: There are many different term charge you happen to be billed, as well as of those to do label searches, safe term insurance rates, and. Title costs are generally just a few hundred for every, if you’re identity insurance rates can be up to $step 1,000.

- Discount factors: You can buy factors to decrease your home loan rates, always for example% of your amount borrowed for every. Speaking of recommended and certainly will become talked about along with your lender ahead of your time.

- Credit file: Your lender commonly remove your credit score inside your software processes. Which usually clocks among $twenty-five and you will $75 for each and every applicant.

- Better, septic and you will pest check charge: Depending on your area therefore the property you’re to acquire, you want specific checks over on assets. These types of charge will vary in accordance with the scope of the job, and regional work costs. You might essentially expect them to end up being anywhere between $three hundred and you can $500 each.

For an exact writeup on exactly what your Virtual assistant settlement costs usually seem like, it’s important to review the mortgage imagine given to you because of the your mortgage lender. This may detail all estimated costs we provide, as well as how much cash you’ll want to bring to closing.

Non-Loan Settlement costs

Additionally, you will spend closing costs to possess non-financing relevant issues – homeowners’ insurance costs, county tape costs, HOA expenses, and a lot more. Such will vary based on your residence, place, along with other circumstances.

- Prepayment of your home taxation and you can homeowners insurance: You will need to pre-shell out their projected assets taxes for another month or two, plus insurance premiums throughout the brand new seasons. You can also be required to shell out additional into the escrow account in the event the last expenses discuss the latest estimated matter.

- Daily focus charges: Because you would not create your first-mortgage percentage to have a month or several in the future, you will have to pre-shell out their interest charges for the period. It costs differ based on the loan matter, the rate of interest, whenever from the times you order.

- Tape charges: For each and every county charges certain charge to help you record mortgage files and you can file them in the personal list. These types of are very different according to your area.

In many cases, your own a house agent’s fee is generally used in your own closing can cost you, however these are paid for because of the supplier and they are not within the Virtual assistant financing costs getting buyers. Talk to your agent if you’re not sure the way they rating reduced (or by exactly who).

Va finance provide benefits getting being qualified borrowers, certainly which is the power to purchase discount points that normally reduce the will cost you along side longevity of your loan.

Virtual assistant Jumbo Money Told me

Va jumbo funds render an easy method to own Pros or any other army players to shop for a property in more pricey areas of brand new nation.

Virtual assistant Rate of interest Avoidance Refinance loan

The Virtual assistant Interest rate Avoidance Refinance mortgage (IRRRL), also known as this new Va Improve Re-finance, is amongst the greatest options for current Virtual assistant financing owners who wish to benefit from lower rates of interest or re-finance on the a fixed-rates home loan.

Va Loan Pricing

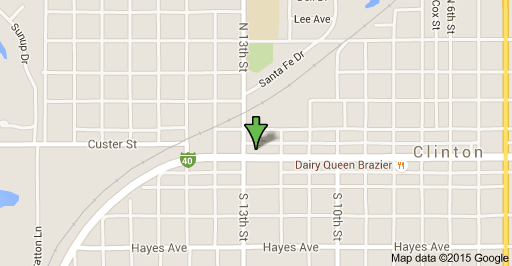

cash advance Westcliffe locations

Know the way your own rate are calculated additionally the points that go on choosing the new Va Mortgage rate you will get, plus the benefits of Va financing prices.

Va Dollars-Away Re-finance

On Virtual assistant home loan process lenders should look whatsoever of your own expenses. For example child care in which you could be requested to produce a Va Child care Report.